Healthcare

Healthcare and Life Sciences sector is comprised of businesses which have high levels of IP and technological know-how, mission-driven teams, and potential to become international champions. The rapid pace of change in some areas of technology and molecular biology lends it to entrepreneurial teams and investors like Inflexion.

Portfolio

Filter by

CNX Therapeutics

Pharmaceuticals

In 2021 Inflexion acquired CNX Therapeutics, a European pharmaceutical company dedicated to the supply of essential medicines. The business was formed when Inflexion acquired Sunovion Pharmaceuticals Europe Limited. View case study

European LifeCare

Vaccination Services

In 2018 Inflexion invested in European LifeCare, Europe's largest independent provider of travel clinics and public vaccination programmes. View case study

HKI

Healthcare information services

In 2004 Inflexion acquired public health performance analytics business HKI in a £10m deal. The business was later sold in two parts for an overall return of 2.6x. View case study

ICS

Temporary staffing solutions

Temporary healthcare staffing business ICS chose to partner with Inflexion in 2008. It was sold 22 months later to Blackstone Group for an overall return on investment of 2.9x. View case study

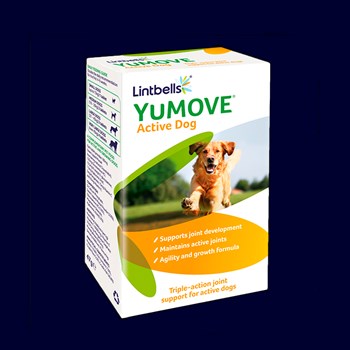

Lintbells

Supplements for pets

Lintbells is a globally recognised leader in pet supplements. Inflexion invested in the business in 2017, before selling it to Vetnique Labs in 2024. View case study

Medivet

Veterinary services

In 2016, Inflexion provided minority funding to support the expansion of Medivet, a UK veterinary pet-care business. A successful partnership delivered strong acquisitive and organic growth, and Medivet was sold in 2021 to CVC Capital Partners. View case study

Pharmaspectra

Medical affairs data

In 2019, Inflexion invested in Pharmaspectra, a leading global provider of medical affairs data to the pharmaceutical and biotech industry. Inflexion exited the business in 2022. View case study

Phlexglobal

Clinical research documentation management

Inflexion backed the buyout of TMF services provider Phlexglobal in 2011, supporting its growth until it was sold to Bridgepoint Development Capital in 2014. View case study

Proteros

Drug discovery research platform

Proteros Biostructures GmbH is a leading Germany-based founder-led contract research organisation focused on early-stage drug discovery. View case study

Rosemont Pharmaceuticals

Liquid pharmaceuticals

In 2020 Inflexion acquired Rosemont Pharmaceuticals, the UK’s leading liquid pharmaceuticals business. The business was carved out of listed parent company, Perrigo. View case study

SteriPack

Medical device contract designer and manufacturer

SteriPack is a leading global contract manufacturer serving the medical device, pharmaceutical and diagnostic markets. Inflexion led the buyout of SteriPack in 2022. View case study

TPP

Veterinary platform

In 2024, Inflexion invested in Tierarzt Plus Partner (“TPP”), Germany’s largest group of veterinary practices. View case study

Upperton Pharma Solutions

Particle engineering for the pharmaceutical industry

In 2022, Inflexion made a substantial investment into Upperton Pharma Solutions, a UK based specialist contract development and manufacturing organisation which has expertise in particle engineering for the pharmaceutical industry. View case study

Village Vets

Veterinary services

Village Vets is the largest independent group of veterinary practices in the Republic of Ireland. Inflexion’s Enterprise Fund invested in the business in 2024 to support management’s ambitions to provide an enhanced offering to its customers through organic and acquisitive growth. View case study

Team

Andrew Neville

Partner

Andrew is a partner and focusses on investments into Healthcare and Life Sciences. He led Inflexion’s investments into Upperton Pharma Solutions, Proteros and TPP and has been involved with a number of Inflexion’s majority and minority investments including Movera, Medivet and Proteros since joining in 2016. Read biography

Christian Fellowes

Investment Director

Christian is an Investment Director on the Healthcare team and brings a combination of medical, transaction and entrepreneurial experience to Inflexion. Read biography

Robin Senivassen

Investment Director

Robin is an Investment Director responsible for transaction execution and supporting the origination of investment opportunities in the lower mid-market. Read biography

Ravi Shah

Investment Director

Ravi is an Investment Director responsible for evaluating and executing transactions. Read biography

Andrea Johnson

Assistant Director

Andrea is an Assistant Director responsible for evaluating and executing transactions as well as supporting the origination of investment opportunities. Read biography

Henry Awit

Assistant Director

Henry is an Assistant Director responsible for evaluating and executing transactions and supporting the origination of investment opportunities in the Healthcare sector. Read biography

Martin Thrane Pedersen

Assistant Director

Martin is an Assistant Director responsible for evaluating and executing transactions and supporting the origination of investment opportunities in the Healthcare sector. Read biography

Olivia Craig

Assistant Director

Olivia is an Assistant Director responsible for evaluating and executing transactions as well as supporting the origination of investment opportunities. Read biography

News, insights and events

Articles